County discusses House Resolution 1022, FLOST

Published 11:11 am Friday, November 22, 2024

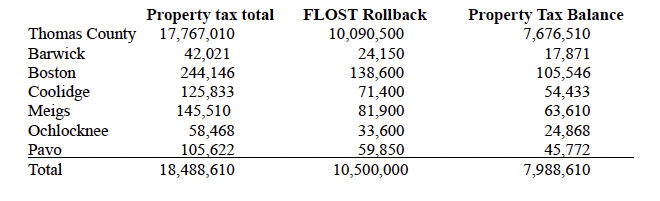

- SHARING AN EXAMPLE: In this hypothetical, residents can see that by adopting the FLOST rollback with the new property tax balance, the county will still receive the same amount as the property tax total.

THOMASVILLE- Georgia voters have spoken.

During the November 5th general election, House Resolution 1022 passed with 63% support and Referendum A passed with 65.4% percent support, reflecting an ongoing effort to balance fair tax assessments with community needs.

Referendum A increased the exemption limit by raising the assessed value exemption for tangible personal property from $7,500 to $20,000. This will reduce property tax burdens for homeowners and small businesses.

House Resolution 1022 will cap the property tax increases for homeowners based on the statewide inflation rate, limiting tax spikes in rising markets.

While these are positive changes for homeowners, there are negative implications for counties across Georgia.

Referendum A is expected to cost Georgia’s counties approximately $250 million and could potentially impact funding for schools and infrastructure.

But, there is a solution. Counties can compensate for lost property tax revenue by adopting a floating local sales tax (FLOST), which would add one cent to sales tax on goods and services.

The solution is conditional, however. All municipalities must agree. If any municipality opts out of House Resolution 1022, counties cannot adopt a resolution for FLOST.

“We are trying to discourage agencies in Thomas County, either school systems or city governments from doing that because it will not impact our revenues,” County Manager Michael Stephenson explained.

The only way the revenues would not be impacted is if the county uses the calculated rollback rate, implemented by the state, and utilizes the FLOST.

“The state has a rollback rate they calculate every year,” Stephenson said. “The intent of that calculation is to ensure cities, counties, and school systems that if they adopt the rate, they will bring in the same amount as before.”

Stephenson created a hypothetical example, which is provided above, showcasing how the FLOST, along with the property tax levied by jurisdiction would create a 75% reduction in property tax.

“I don’t want to be in the position of telling people they should do this, because it’s a transfer or the tax burden for property taxpayers to sales taxpayers,” he said.

While Stephenson cannot tell the municipalities what to do, the county and municipalities must enter into an agreement before the County Board of Commissioners can vote on a referendum being placed on the March 18 ballot.

“I want the public to know this is an option and to see what they think about it,” Stephenson said. “For me, personally, I’ve heard numerous people say they would rather be paying sales tax than property tax.”

Stephenson concluded by sharing the referendum will be revenue neutral for the county, it will just be a matter of who the public believes should pay the taxes.